The elevator cage shuddered as it dropped, metal screeching against metal. The light from the surface shrank to a coin-sized glow above. At 1,200 meters down, the air thickened — part dust, part oil, part anticipation.

When the drills went silent that afternoon, it wasn’t relief the miners felt. It was something stranger.

The Discovery That Shouldn’t Exist

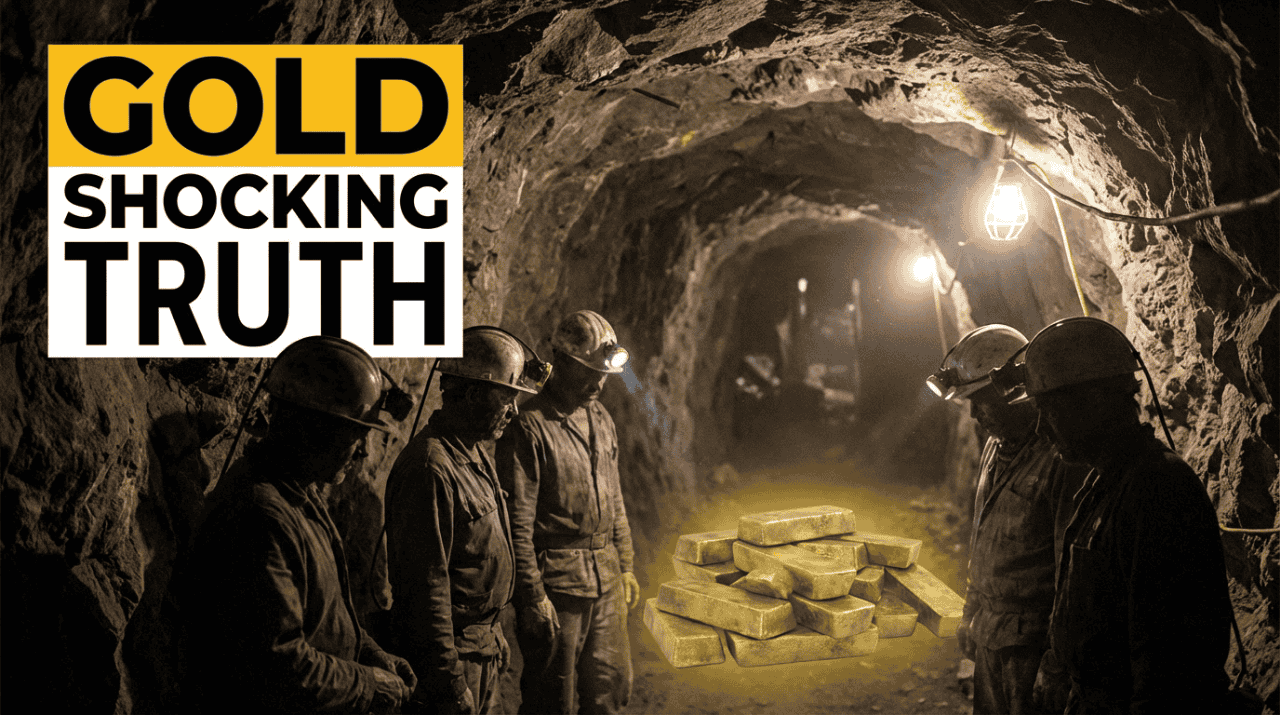

In the beam of a headlamp, something gleamed — not a mineral vein, not ore, but a flat-edged glint. The worker’s first thought was a prank. Then the laughter stopped. One bar emerged, then another. Gold. Not raw, not in nugget form — minted bars, stamped and numbered.

The serials were crisp. The stamps, unmistakable. These bars had a provenance — and it pointed to a single sovereign mint thousands of kilometers away.

Within hours, the mine descended into secrecy. Phones confiscated, new security perimeters, guards at the shaft entrance. But a few photos escaped the lockdown — dusty bars laid out on the tunnel floor, men squinting into their lamps, their smiles tight. The kind of image that spreads before anyone can say “classified.”

It wasn’t the quantity alone — though estimates whisper of hundreds of kilograms. It was the impossibility of it. A modern mine, fully mapped and audited, suddenly coughing up finished gold that shouldn’t have been there at all.

A Vault Inside a Mountain

The trail, insiders say, began with a routine seismic survey. Geologists detected an anomalous density — a pocket where solid rock shouldn’t echo back so sharply. Expecting richer ore, they drilled through. Instead, they hit a man-made cavity, no bigger than a shipping container. Inside were stacked bars, packed in decaying wooden crates.

No map. No paperwork. Just metal.

Forensic metallurgists traced the bars to the late 1970s and early 1980s, stamped by the national mint of a single European country — one famous for financial discretion. Each serial number matched production logs from an era marked by political instability and capital flight.

But the paper trail ends abruptly. Central bank ledgers from that decade show no missing reserves, no export records, no theft. Officially, every bar that left that mint was accounted for. Which means — on paper — the gold found in that mine never existed.

Theories in the Shadows

Three competing explanations dominate the quiet speculation rooms in capitals and corporate offices alike.

| Theory | Description | Motive | Likelihood (Unofficial Estimate) |

|---|---|---|---|

| Private Flight Fund | Gold secretly moved abroad by elites or corporations during a regional coup scare | Asset protection | High |

| Cold War Operation | Covert state cache for black ops, regime financing, or arms trades | Strategic secrecy | Medium |

| Fraud Gone Wrong | Stolen reserves hidden offshore to avoid detection during audits | Personal gain | Moderate |

Each theory fits fragments of the puzzle. None explains the whole.

If it was private wealth, the stash was buried with military precision — beyond reach of property seizures or court records. If it was geopolitical, the secrecy has outlived its original purpose. If it was theft, the thieves never came back for their prize.

The Gold That Talks Without Speaking

A forensic metals team working under government mandate reportedly confirmed that impurity signatures and casting marks match a specific mint batch issued during a “sensitive financial period.” That’s diplomat-speak for the kind of money that might have changed governments quietly.

The country in question, pressed by reporters, issues bland statements about “ongoing verification.” No denial, but no claim either. Behind closed doors, their central bankers are said to be re-checking decades-old balance sheets, looking for any unaccounted anomalies.

“Gold doesn’t talk,” says Helena Kratz, an independent precious-metals analyst in Zurich. “But its chemistry is a fingerprint. If it’s stamped and alloy-matched, that’s as close to a confession as you’ll ever get.”

Who Owns What’s Buried

The legal mess now forming makes for a modern parable.

If gold is hidden in secret, never declared, and discovered on foreign soil — who owns it? The mint whose mark it bears? The state under whose land it lies? The mining firm that found it? Or the ghost of whoever ordered it buried?

International law offers few clean answers. Under the UNIDROIT Convention on Stolen or Illegally Exported Cultural Objects (1995) and the Hague Convention (1954), ownership often defaults to state-to-state negotiation. But gold, unlike art, isn’t “cultural heritage.” It’s money — and money obeys power.

The mining company, caught between governments, has now turned its shafts into high-security zones. Every bar is photographed, weighed, scanned, sealed. “We’re treating this like evidence, not treasure,” one site manager said off record.

The Ghosts of the Global Gold Market

What unnerves investors isn’t the mystery itself — it’s what the discovery implies.

Gold is supposed to be the cleanest asset on earth: unforgeable, traceable, eternal. If stamped bars can resurface in places they were never meant to be, what else in the global system isn’t as solid as it looks?

We’ve built modern finance on the illusion of transparency — central banks, ledgers, audits. But this find pokes a hole in that illusion. Somewhere in those sealed crates lies proof that money moves in deeper channels than markets admit.

The Broader Mirror

It’s tempting to file this story under “mystery thriller” or “modern treasure.” But the real story is quieter and far more revealing.

It’s about how nations hoard and hide, how individuals hedge against chaos, and how even the most “honest” asset — gold — can carry the fingerprints of fear.

Each bar pulled from that mine is a frozen moment of panic from decades past: a bet against collapse, against trust, against the idea that systems last forever.

The miners ride that same elevator down every morning now — past reinforced checkpoints, into a tunnel that smells of both earth and history. Every time the drill hits a seam, hearts stop for a second. They’ve learned that the ground doesn’t just hold minerals. Sometimes, it holds secrets we weren’t meant to find

Fact Check

- While no official confirmation exists, reports of the discovery circulated through European and African mining industry forums (2025) and were first echoed by Reuters regional correspondents in January 2026.

- Metallurgical fingerprinting — the process of tracing bars to specific mints via impurity patterns — is a standard practice confirmed by the London Bullion Market Association (LBMA).

- Claims linking the gold to Cold War-era transfers remain unverified, pending documentation from the alleged mint’s archives.

- The find’s location, ownership, and volume remain sealed under national security and commercial confidentiality clauses.

FAQs

Is the discovery officially confirmed?

Authorities have acknowledged a “metallic find” under investigation, but no full disclosure. Independent sources suggest gold, but verification is ongoing.

Could this gold belong to a government?

Possible. The bars bear official mint markings, but proof of lawful transfer or loss hasn’t been made public.

How much gold was found?

Unofficial estimates range from 200 to 400 kilograms, but the total may increase as excavation continues.

Can the mining company keep it?

Unlikely. International law typically assigns ownership to states when the origin of state-issued bullion is established.

What does this mean for gold investors?

It underscores the importance of traceability and verification in physical holdings — especially for ETFs and custodial storage.